Financial Giants Gear up to Combat Climate Risks

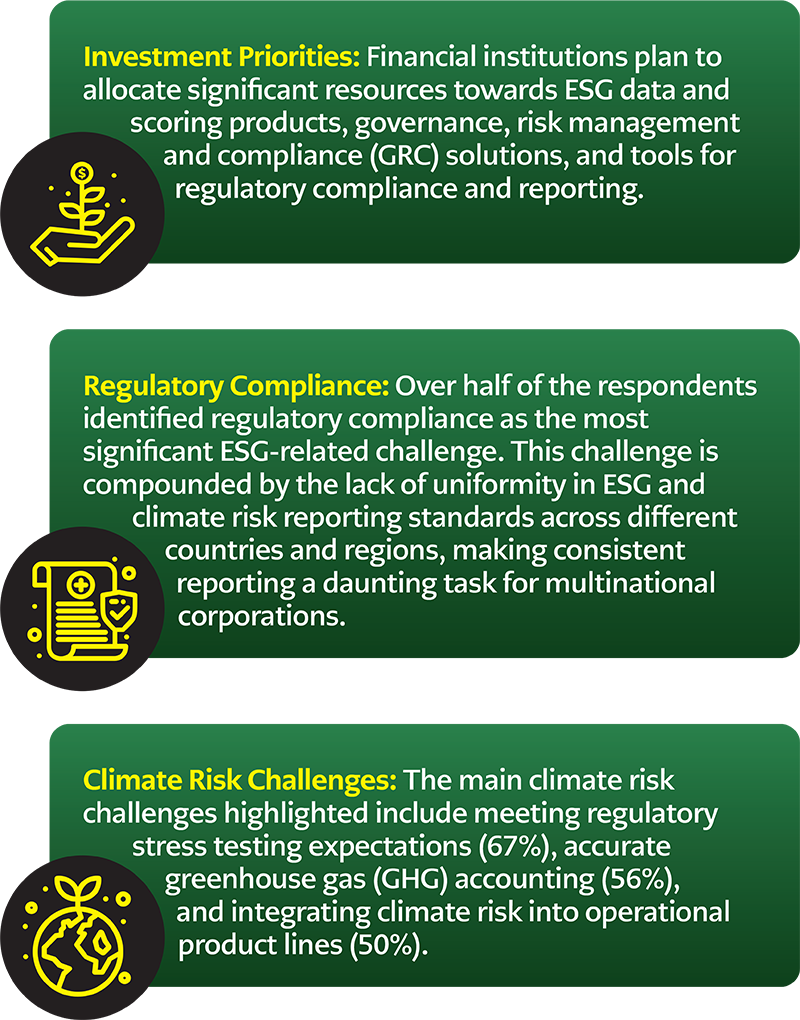

A study reveals regulatory compliance as the top challenge for ESG integration, with significant investments planned for emissions data and climate risk solutions.

As the climate crisis intensifies, financial institutions worldwide are ramping up their investments in Environmental, Social, and Governance (ESG) technologies. According to a recent BCT Digital and Chartis Research survey, over 72% of global financial institutions are set to invest up to US$500,000 or more in ESG technology to enhance climate risk solutions. These investments focus on emissions data, transitional climate risk modelling, and regulatory reporting tools.

The “Chartis Market View: ESG and Climate Risk Survey” gathered insights from 77 ESG and climate risk practitioners across financial institutions with assets under management ranging from US$1 billion to US$500 billion. Participants represented APAC, North America, Europe, and the MENA region.

>

>

Strategic Shifts

Most firms review their ESG strategies quarterly, with North American and European institutions more likely to exceed the US$500,000 mark in annual ESG spending. Next year’s investments are projected to hone in on data management frameworks that span the entire value chain, a crucial step in addressing the complex compliance landscape.

Jaya Vaidhyanathan, CEO of BCT Digital, emphasised the need for integrated data management frameworks to navigate the compliance landscape effectively. “The disparity in ESG and climate risk reporting standards across regions poses a significant challenge. This survey provides valuable insights for financial institutions aiming to enhance their ESG and climate risk management frameworks,” she stated.

Sid Dash, Chief Researcher at Chartis, added, “Having a fully integrated framework for data management across the entire value chain is crucial for compliance. Financial institutions must invest in robust ESG technologies to meet the growing regulatory demands and address climate risks efficiently.”

As the financial sector gears up for these substantial investments, the emphasis on ESG and climate risk technologies underscores the industry’s commitment to mitigating climate-related risks and adhering to evolving regulatory standards.

This strategic shift aims to protect financial assets and contributes to broader- environmental sustainability goals. This comprehensive approach to integrating ESG factors into risk management and investment decision-making processes marks a significant step towards a more resilient and sustainable financial ecosystem.

>

>