- Key Aspiration Productivity Nexus 2021

- King of Fruits in the Land of the Rising Sun

- Malaysia External Trade Statistics

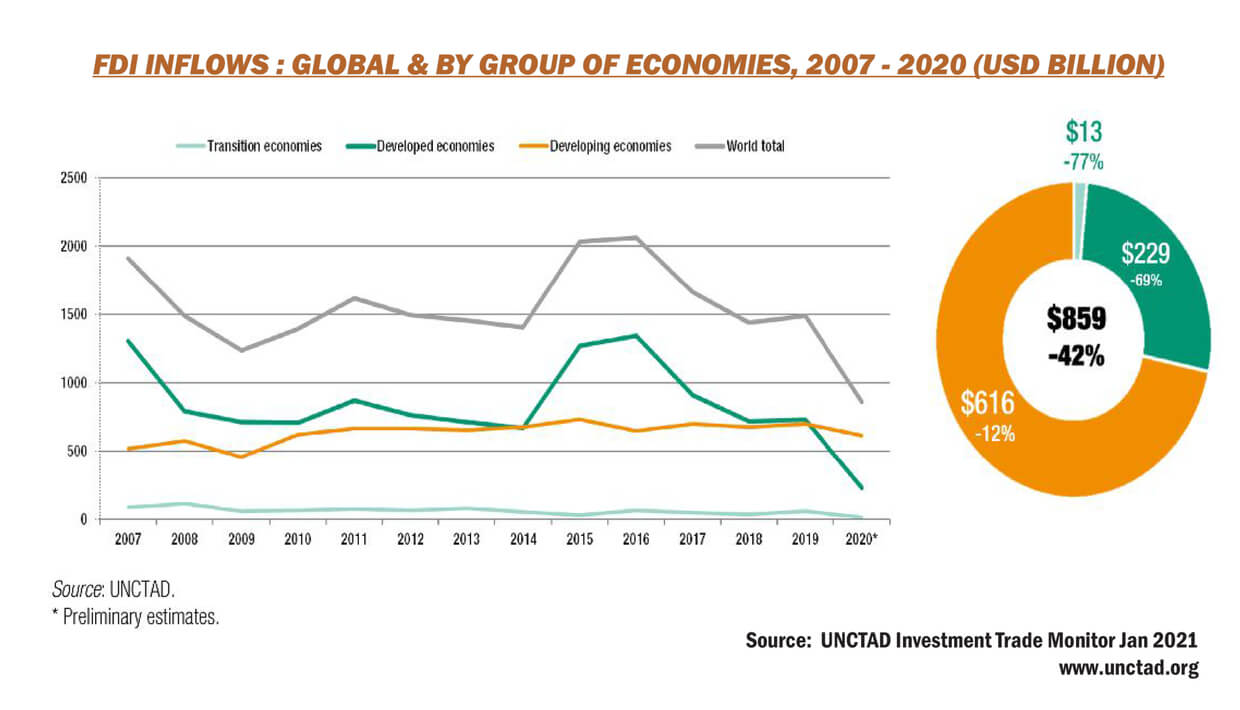

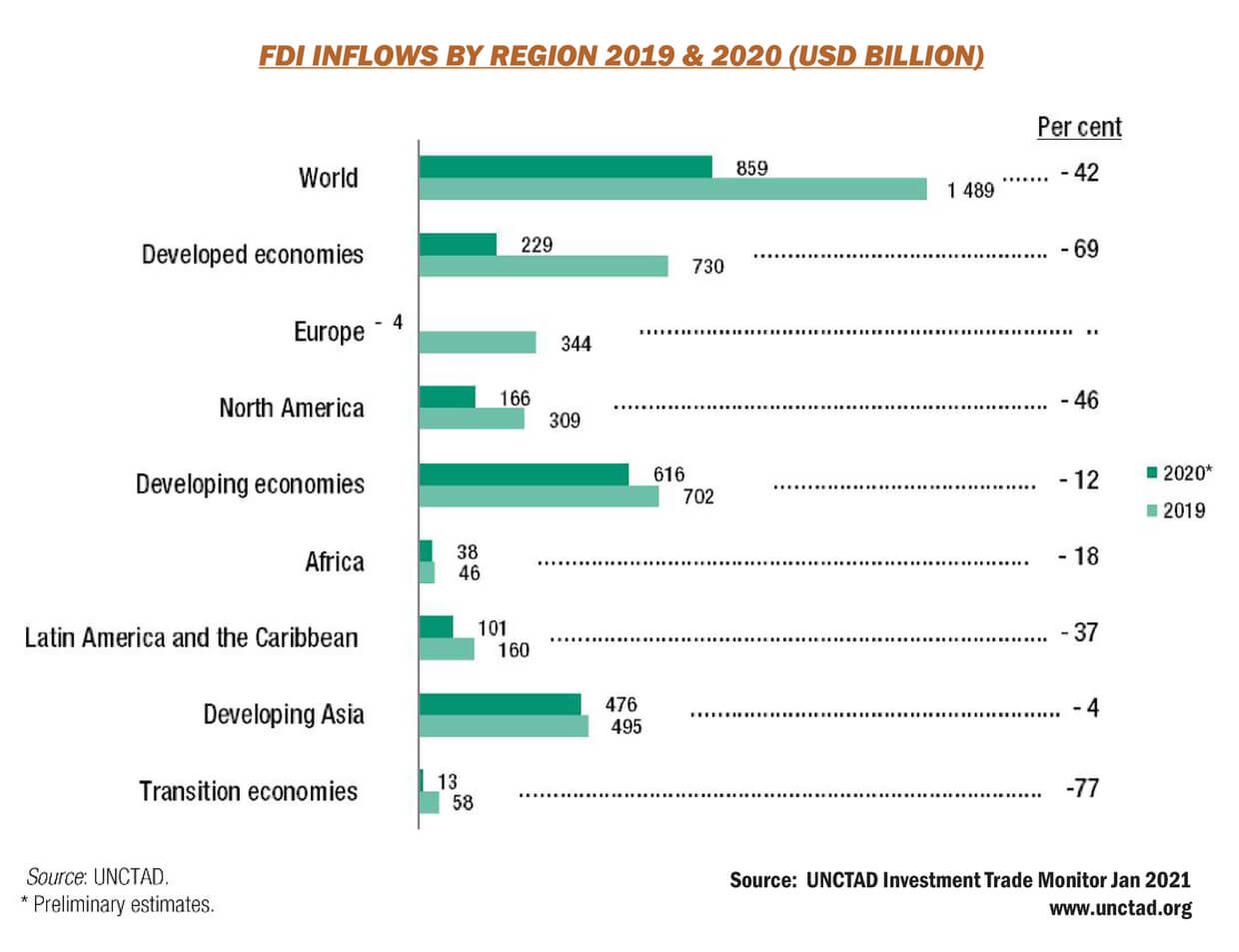

- Malaysia, High-Value Investment Destination in Asia

- Malaysia, Investment Destination of Choice

- Pandemic-fuelled Growth for Retail on e-Commerce

- Specialised Services a Boon for SMEs

- Trudging on in the Wake of COVID-19

- Update to Safeguard Investigation into Ceramic Imports